The last decade has seen an immense technological disruption across industries, including finance. Only a few years ago, digital lending was dismissed as a mere “buzzword”, but the exponential growth of fintechs in the sector has resolved all such doubts. BCG has estimated that India’s digital lending market will grow from ₹ 3.9 trillion in 2018 to ₹ 24 trillion by 20231. This would make the share of digital lending at 48 % of the overall lending market.2 Customer expectations have grown due to what is called the ” Amazon Effect”, and financial institutions are struggling to keep up and provide a frictionless user experience. They need to think beyond “minimizing the number of clicks” & transform all their current processes to better accommodate a digital savvy customer. According to a research, 75% of MSMEs in India are comfortable with sharing data digitally3. Data, advanced analytics & AI can thus be leveraged to eliminate steps & improve processes.

Disrupting through innovative models

Fintechs have pioneered new models of doing business to disrupt the lending space by making their processes more customer-centric. A few examples of models that are gaining foothold in the market are as follows-

- PoS based Lending- Since 47% MSMEs have adopted digital tools for accounting, payments & sales4, data from PoS machines of merchants , like credit/debit card swipes & online sales can be used to offer unsecured loans . For example, NeoGrowth offers a unique product to SMEs by using PoS data for underwriting loans, coupled with an option of automatic daily repayments.

- Data aggregator based business loans– Fintechs like Indifi offer loans tailored for specific segments such as travel, restaurants, e-commerce by using data from data aggregators like MakeMyTrip or Swiggy to assess the risk profile of the borrower. For example, a small restaurant can avail a loan on the basis of its transactions & customer ratings with Swiggy and Zomato

- Mobile-data based lending– Few fintechs like Capital Float use applicant’s mobile data such as banks transaction SMS history, mobile recharge information & call patterns to assess creditworthiness of borrowers.

- Invoice financing- Short-term working capital needs of businesses are financed by fintechs like KredX, who extend loans by discounting unpaid invoices to a network of banks, NBFCs, wealth managers etc. When the invoice is successfully paid, the full amount gets credited to the investors directly.

- Marketplaces– Fintechs such as Paisabazaar not only meet financial needs of consumers but also provide them with a choice of the financial institution they want to avail a loan from . It offers consumers a seamless end-to-end digital experience & is popular with millennials who can fulfill their “impulse purchase” & ” emergency fund” needs.

- P2P Lending- Digital marketplaces like Faircent connect borrowers with lenders allowing quick access to low-cost loans at affordable costs.

An Enabling Regulatory Environment

The Indian regulatory environment has evolved rapidly in the past few years, providing a favorable environment for the growth of fintechs. Few initiatives that have improved the company’s digital infrastructure are as follows-

- Launch of GST- It has enabled wider availability of digitized data, which could be harnessed by lenders for credit scoring

- Startup India- The scheme aims to provide regulatory & financial support to startups, and has led to an increase in the number of fintech players in the country.

- Launch of IndiaStack- The unified software platform is a set of open APIs that could be utilized by banks, telecom operators as well as fintech lenders to gain insights into consumers across segments & offer them innovative lending solutions.

- Recognizing P2P Lenders- RBI has categorized P2Ps as NBFCs, enabling growth of the segment.

- Regulatory Sandbox- This RBI initiative allows Fintechs to test their products & innovations on a small scale & in a controlled environment before rolling them out. This allows digital lenders experiment with their innovative solutions with regulatory backing.

Reimagining Traditional Lending

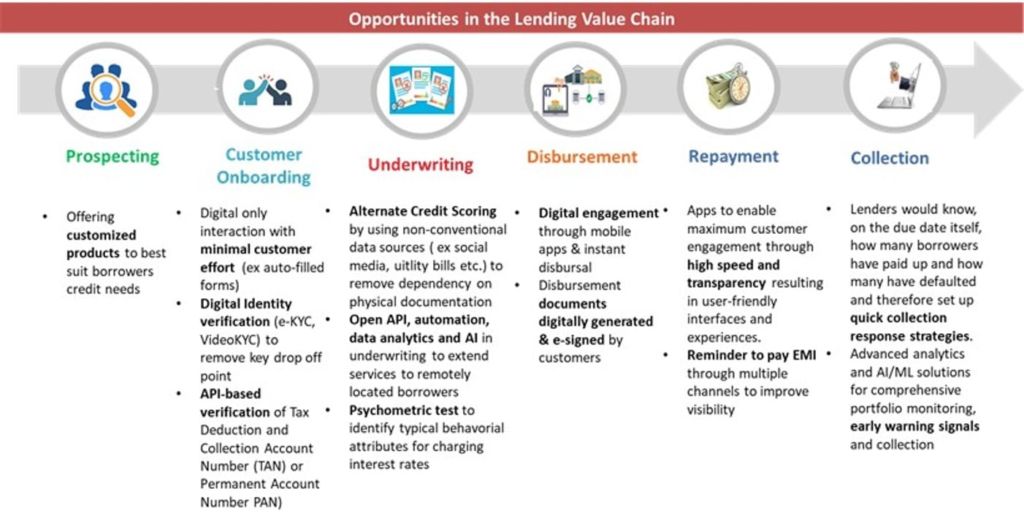

Fintechs in the digital lending space can leverage advanced technologies & regulatory provisions to reimagine & restructure the traditional lending value chain. Specific touchpoints can be targeted to enhance customer experience & drive operational efficiency by eliminating the customer drop-off points from the traditional lending model. A seamless user experience can thus be offered by reducing turnaround times & disburse loans in seconds.

Using Salesforce to create Smarter, Faster & more Personalized Experience

With all these challenges and opportunities in digital lending, having a CRM system like Salesforce for loan origination, management & risk decisioning becomes a major differentiating factor. Integration of ecosystems to generate a single data set on Salesforce, can help increase decision speeds. Here are few advantages that Digital Lending platforms can leverage through Salesforce-

- Real Time onboarding, decisioning & approvals– Salesforce helps in integrating internal, external as well as credit bureau data to make real time decisions & operationalize risk models within minutes.

- Making Lending process more transparent for everyone– With a 360-degree view of customers at a glance, the entire lending process can be unified through a single platform, giving borrowers, lenders & underwriters, a transparent view of the lending process.

- Tailoring the right product for the right customer– Salesforce collates customer data from various sources to exactly know what customers need & when they need it.

- ‘Moment of Truth’ offers based on customer behavior– Integrating Salesforce with a loan decisioning solution allows a business to preapprove customers for specific offers. This ensures that it only promotes offers that are suitable for the customer and improves the application process.

- Understanding ‘Importance of Life events’ – Data analytics from Salesforce data can help businesses predict a customer’s need for financial services based on event or behavior triggers such as marriage, saving habits etc. & help reach out to them through personalized marketing campaigns.

Technological disruptions & availability of data has shifted the power from the lender to the consumer. New lending models which keep customer experience in the forefront can thus use Salesforce as a technology platform for digital lending. With an inevitable explosion of these customer-centric lending models, there’s no doubt that Salesforce is expected to be right at the centre of it.

References

- https://www.business-standard.com/article/technology/india-s-digital-lending-market-represents-a-1-trillion-opportunity-118072600037_1.html

- https://www.business-standard.com/article/technology/india-s-digital-lending-market-represents-a-1-trillion-opportunity-118072600037_1.html

- Omidyar Network- BCG Report : Credit Disrupted Digital MSME Lending in India https://www.omidyar.com/sites/default/files/file_archive/18-11-16_Report_Credit_Disrupted_Digital_FINAL.pdf

- PWC : A wider circle Digital lending and the changing landscape of financial inclusion, November 2019 https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/publications/a-wider-circle-digital-lending-and-the-changing-landscape-of-financial-inclusion.pdf